US & A Consultancy

In today’s digital age, small business owners have access to a wide range of bookkeeping tools and software that can simplify financial management, improve accuracy, and save time. In this blog, we’ll explore five essential bookkeeping tools that every small business owner should know about to streamline their accounting processes and stay on top of their finances.

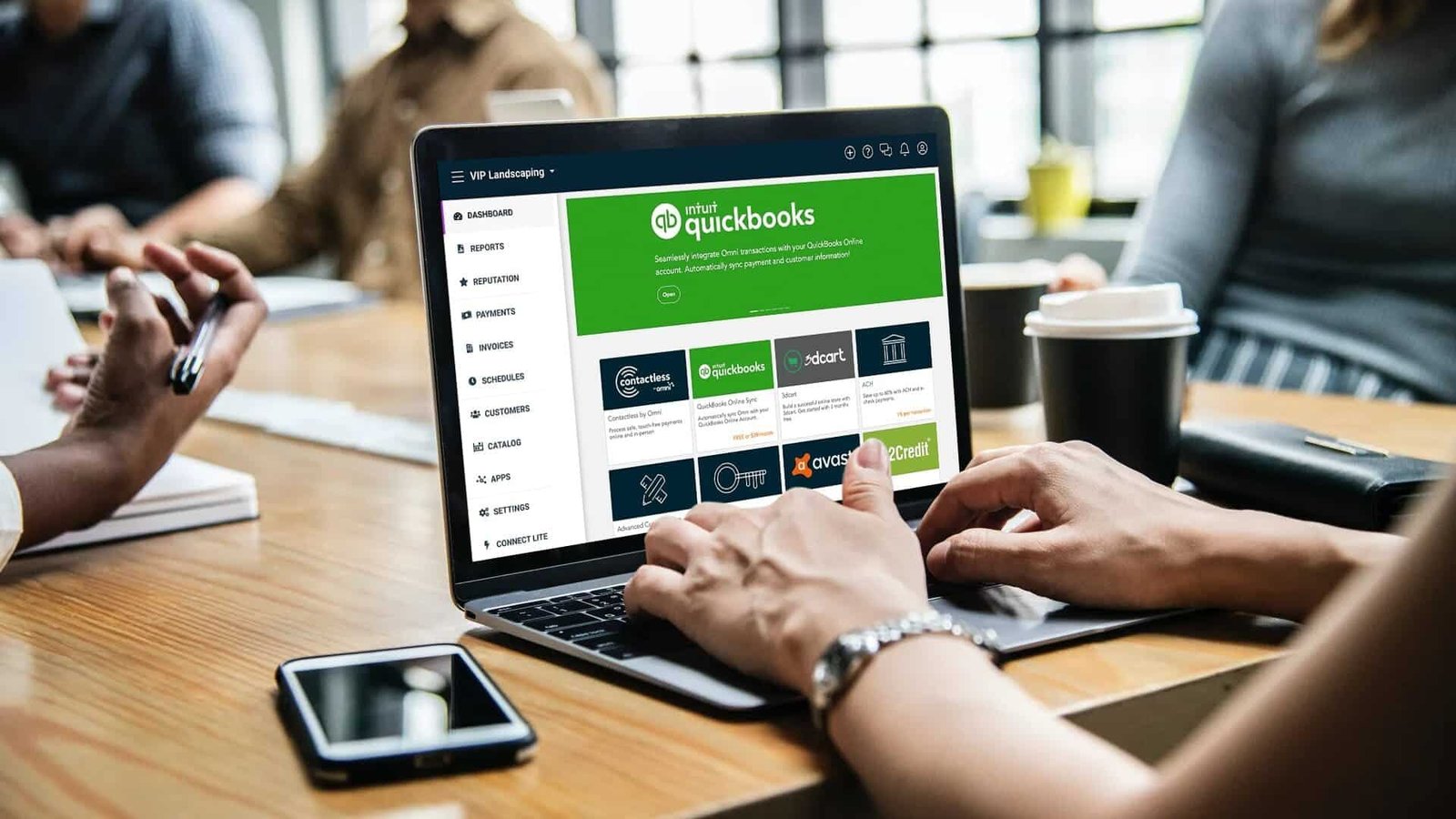

QuickBooks Online

- QuickBooks Online is one of the most popular cloud-based accounting software solutions for small businesses.

- It allows users to track income and expenses, create invoices, manage bank transactions, and generate financial reports.

- With features like automatic bank reconciliation and mobile access, QuickBooks Online offers convenience and flexibility for small business owners on the go.

Xero

- Xero is cloud-based accounting software that is highly regarded for its user-friendly interface and robust features.

- It offers similar functionalities to QuickBooks Online, including invoicing, expense tracking, bank reconciliation, and financial reporting.

- Xero also integrates with a wide range of third-party apps and services, making it easy to customize and expand its capabilities to suit your business needs.

FreshBooks

- FreshBooks is a cloud accounting software designed specifically for freelancers and small service-based businesses.

- It offers features such as time tracking, project management, invoicing, expense tracking, and online payment processing.

- FreshBooks is known for its intuitive interface and user-friendly design, making it a great choice for entrepreneurs who are new to accounting software.

Wave

- Wave is a free accounting software that offers a suite of financial tools for small businesses, including invoicing, accounting, payroll, and receipt scanning.

- While Wave lacks some advanced features found in paid accounting software, it provides essential functionality for managing finances without any cost.

- Wave’s simplicity and affordability make it an attractive option for startups and small businesses with limited budgets.

Expensify

- Expensify is a cloud-based expense management software that simplifies the process of tracking and reporting business expenses.

- It allows users to capture receipts, track mileage, categorize expenses, and generate expense reports with ease.

- Expensify integrates seamlessly with accounting software like QuickBooks Online and Xero, streamlining the reconciliation process and ensuring accurate financial records.

Outsourced bookkeeping services from US & A Consultancy are scalable and adaptable to meet the evolving needs of businesses, whether it’s managing day-to-day transactions or handling peak periods of activity.

Businesses can customize their bookkeeping service package based on their specific requirements, adjusting services as needed to accommodate growth or changes in business operations.